Neuroeconomics and Financial Decision-Making: Delving into the Neural Basis of Investment Choices

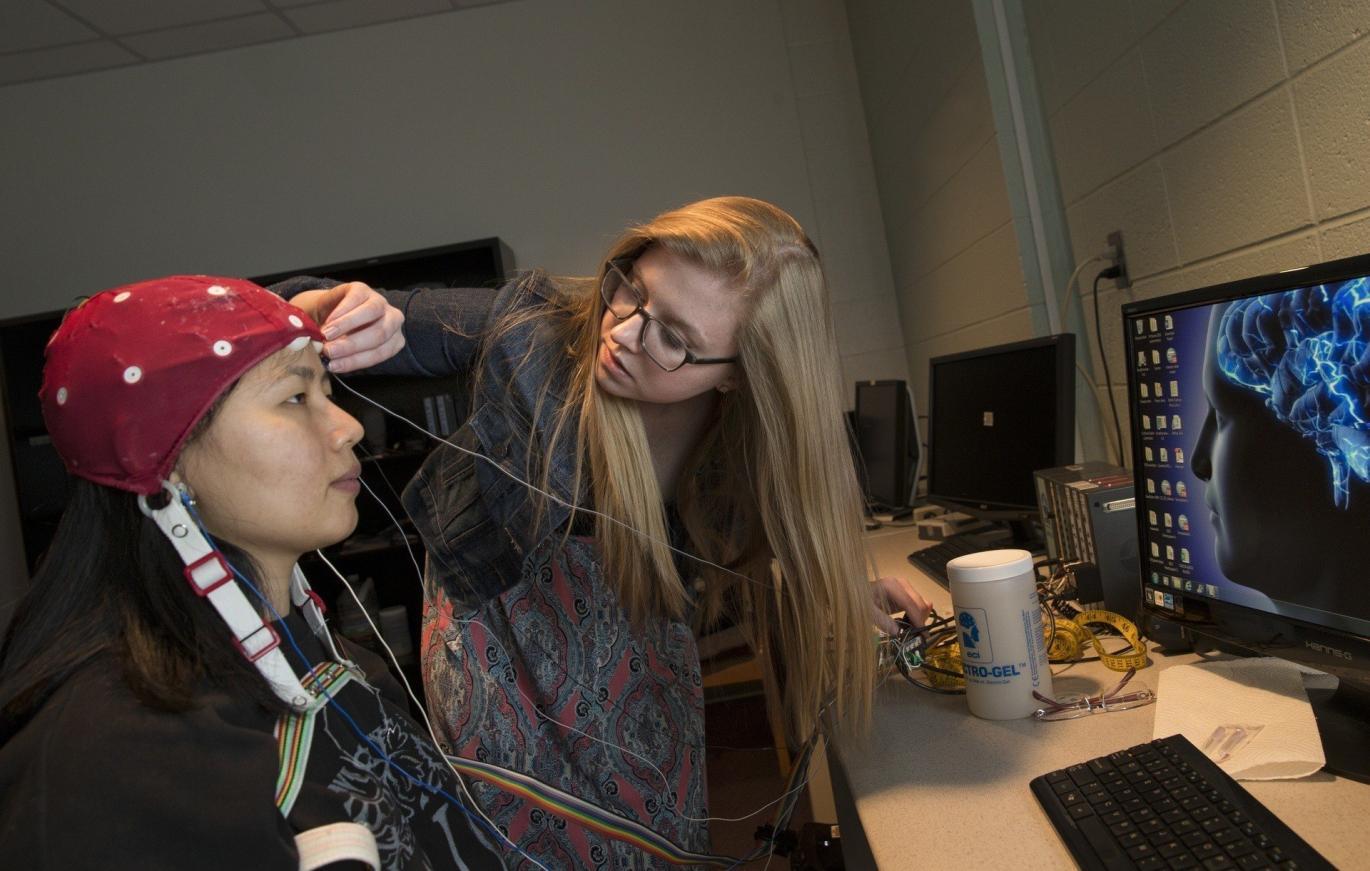

The field of neuroeconomics seeks to understand the neural basis of financial decision-making. By studying the brain activity of investors, neuroeconomists aim to gain insights into how people make investment choices, how they perceive risk and emotions, and how cognitive biases influence their decisions. This knowledge can have significant implications for financial advisors and investors, helping them to make better investment decisions and avoid costly mistakes.

The Brain's Reward System And Financial Decision-Making

The brain's reward system plays a crucial role in financial decision-making. When people anticipate a reward, such as a financial gain, the brain releases dopamine, a neurotransmitter associated with pleasure and motivation. This release of dopamine reinforces the behavior that led to the reward, making it more likely to be repeated in the future. This mechanism helps explain why people are often drawn to risky investments with the potential for high returns, even if the probability of success is low.

- Studies have shown that the anticipation of financial gains activates the brain's reward system, leading to increased dopamine release.

- This release of dopamine reinforces the behavior of seeking financial rewards, making it more likely that people will continue to make risky investments.

- The brain's reward system also plays a role in loss aversion, the tendency for people to feel the pain of losses more strongly than the pleasure of gains.

Risk Perception And Emotional Factors In Investment Decisions

Risk perception and emotional factors also significantly influence financial decision-making. The amygdala, a brain region involved in processing fear and emotions, is activated when people perceive risk. This activation can lead to increased anxiety and stress, which can impair decision-making. Additionally, emotions such as fear, greed, and overconfidence can cloud judgment and lead to poor investment choices.

- Studies have shown that people who are more risk-averse exhibit greater activation of the amygdala when presented with risky investment options.

- Emotional factors, such as fear and greed, can also influence investment decisions. Fear can lead to excessive risk aversion, while greed can lead to excessive risk-taking.

- Investors who are able to control their emotions and make decisions based on rational analysis are more likely to make sound investment choices.

Cognitive Biases And Heuristics In Financial Decision-Making

Cognitive biases and heuristics are mental shortcuts that people use to make decisions quickly and efficiently. However, these shortcuts can sometimes lead to irrational investment choices. For example, the availability heuristic leads people to overweight recent information and ignore historical data, which can result in poor investment decisions.

- Cognitive biases, such as the availability heuristic and the confirmation bias, can lead investors to make irrational investment choices.

- The availability heuristic leads people to overweight recent information and ignore historical data, which can result in poor investment decisions.

- The confirmation bias leads people to seek out information that confirms their existing beliefs, which can lead to biased decision-making.

Neuroeconomics And Financial Market Behavior

Neuroeconomics can provide insights into financial market behavior. For example, neuroeconomic research has shown that market anomalies, such as the equity premium puzzle, may be explained by the brain's reward system. Additionally, neuroeconomic research can help explain why investors often overreact to news and information, leading to market bubbles and crashes.

- Neuroeconomic research can provide insights into financial market behavior, such as market anomalies and bubbles.

- The brain's reward system may explain why investors often overreact to news and information, leading to market bubbles and crashes.

- Neuroeconomic research can also help explain why investors are often reluctant to sell losing investments, a phenomenon known as the disposition effect.

Implications For Financial Advisors And Investors

The findings of neuroeconomics research have implications for financial advisors and investors. Financial advisors can use neuroeconomic principles to help clients make better investment decisions. For example, they can help clients identify and overcome cognitive biases, manage their emotions, and make decisions based on rational analysis.

- Financial advisors can use neuroeconomic principles to help clients make better investment decisions.

- Advisors can help clients identify and overcome cognitive biases, manage their emotions, and make decisions based on rational analysis.

- Investors can also benefit from understanding neuroeconomics. By being aware of the brain's reward system and how it influences investment decisions, investors can make more informed and rational choices.

Neuroeconomics is a rapidly growing field that is providing valuable insights into the neural basis of financial decision-making. This research has implications for financial advisors and investors, helping them to make better investment decisions and avoid costly mistakes. As neuroeconomic research continues to advance, we can expect to gain a deeper understanding of the brain's role in financial decision-making and develop more effective strategies for helping investors achieve their financial goals.

YesNo

Leave a Reply