What Are the Challenges of Using Brain Science in Accounting?

Introduction

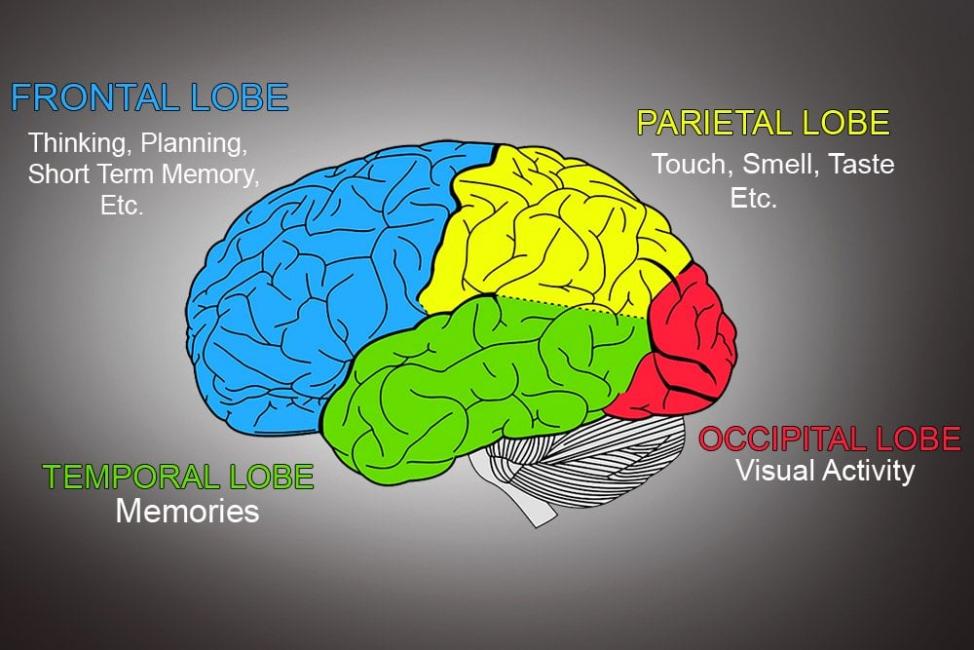

Brain science, also known as neuroscience, is the study of the nervous system, including the brain. It is a relatively new field, but it has already had a significant impact on our understanding of human behavior. As a result, there is growing interest in using brain science to improve accounting practices.

However, there are a number of challenges that need to be addressed before brain science can be widely used in accounting. These challenges include:

Challenges Of Using Brain Science In Accounting

- Lack of understanding of the brain and its functions

- Ethical concerns

- Limited research in the field of accounting

- Practical challenges

The brain is a complex organ, and we still do not fully understand how it works. This makes it difficult to apply brain science to accounting.

There are a number of ethical concerns that need to be addressed before brain science can be used in accounting. These concerns include privacy issues and the potential for misuse of brain science.

There is a limited amount of research that has been conducted on the use of brain science in accounting. This makes it difficult to draw any definitive conclusions about the benefits of using brain science in this field.

There are a number of practical challenges that need to be addressed before brain science can be widely used in accounting. These challenges include the cost of brain imaging technology and the time-consuming nature of brain research.

Overcoming The Challenges

Despite the challenges, there are a number of ways to overcome them. These include:

- Collaboration between neuroscientists and accountants

- Development of ethical guidelines

- Increased research in the field of accounting

- Investment in brain imaging technology

Collaboration between neuroscientists and accountants is essential for the successful use of brain science in accounting. This collaboration can help to ensure that brain science is used in a responsible and ethical manner.

The development of ethical guidelines is also important for the responsible use of brain science in accounting. These guidelines can help to protect the privacy of individuals and ensure that brain science is not misused.

Increased research in the field of accounting is needed to validate the findings of existing studies and to explore new applications of brain science in accounting.

Investment in brain imaging technology is also needed to make this technology more affordable and accessible. This will help to facilitate the use of brain science in accounting.

The use of brain science in accounting is a promising new field that has the potential to revolutionize the way that we understand and practice accounting. However, there are a number of challenges that need to be addressed before brain science can be widely used in accounting. These challenges include the lack of understanding of the brain and its functions, ethical concerns, limited research in the field of accounting, and practical challenges. Despite these challenges, there are a number of ways to overcome them. These include collaboration between neuroscientists and accountants, the development of ethical guidelines, increased research in the field of accounting, and investment in brain imaging technology. By addressing these challenges, we can help to ensure that brain science is used in a responsible and ethical manner to improve accounting practices.

YesNo

Leave a Reply