How Can Brain Imaging Help Accountants Understand the Impact of Stress on Financial Performance?

The field of accounting and finance has traditionally focused on numerical data and financial statements to assess an organization's performance. However, in recent years, there has been growing interest in the role of human factors, such as stress, in shaping financial outcomes. Brain imaging techniques offer a unique window into the neurobiological mechanisms underlying stress and its impact on financial performance, providing valuable insights for accountants and financial professionals.

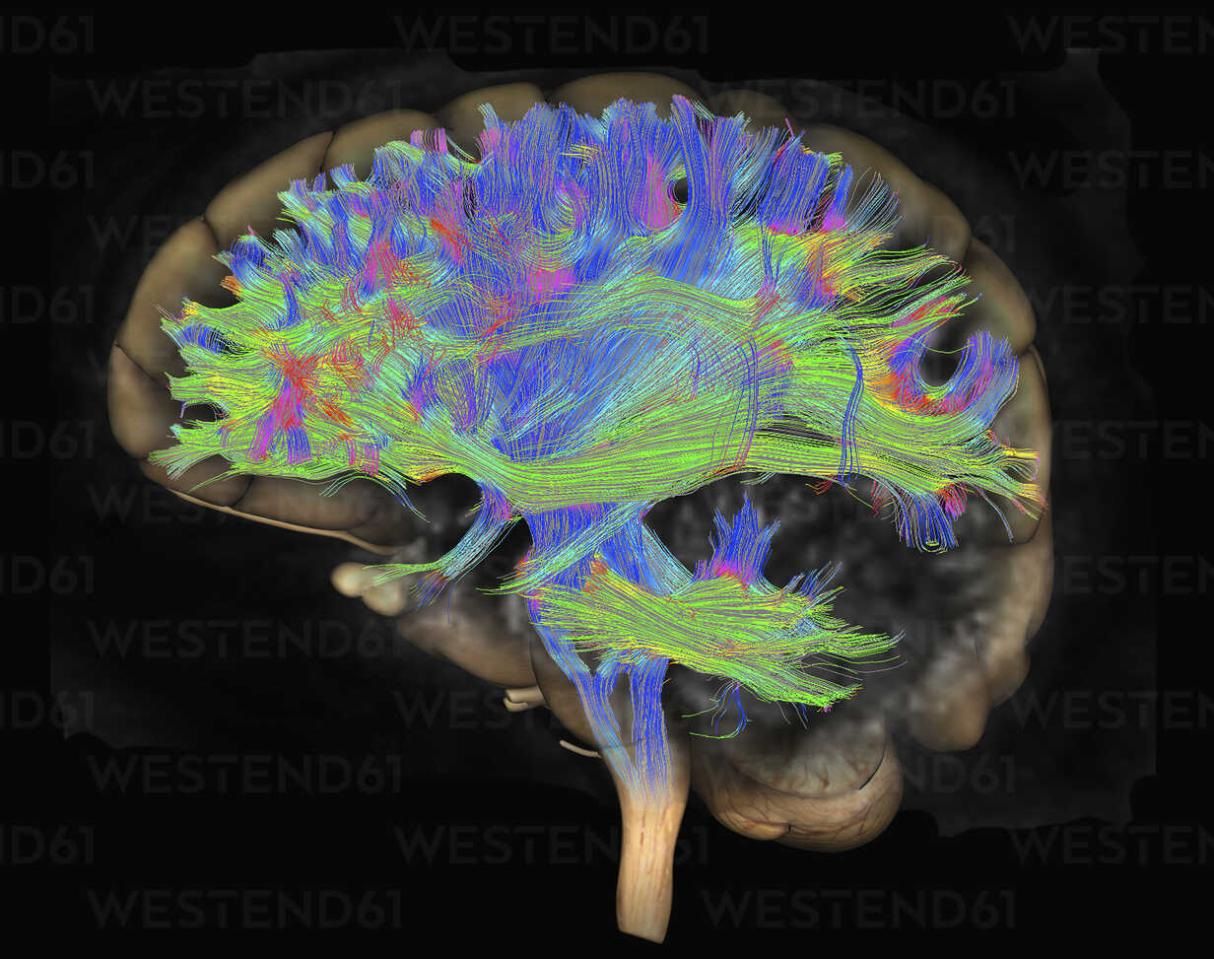

Brain Imaging Techniques

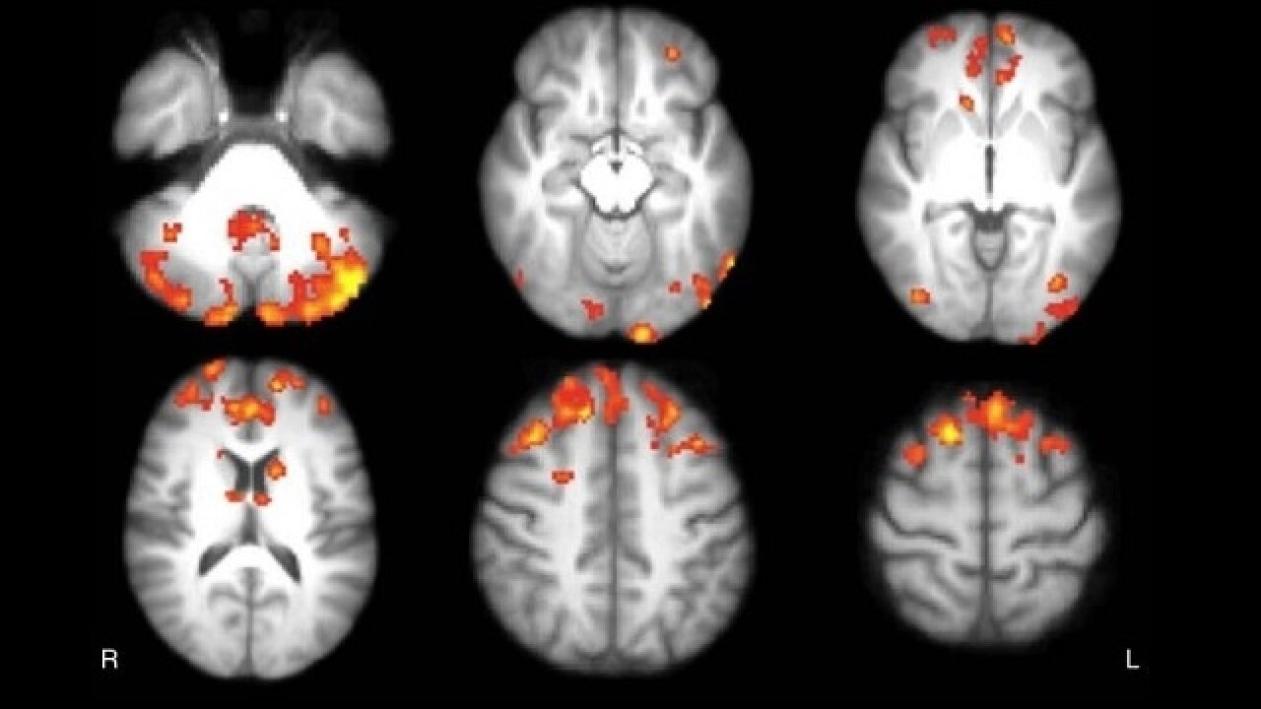

- fMRI (functional Magnetic Resonance Imaging): Measures changes in blood flow to different brain regions, indicating neural activity. It is widely used to study brain function, including stress responses.

- EEG (Electroencephalography): Records electrical activity in the brain, providing information about brainwave patterns and neural oscillations. EEG can be used to assess stress levels and cognitive function.

- PET (Positron Emission Tomography): Involves injecting a radioactive tracer into the bloodstream, which accumulates in active brain regions. PET scans can visualize neurochemical changes associated with stress and financial decision-making.

Neurobiological Mechanisms Of Stress

Stress activates the brain's stress response systems, including the hypothalamic-pituitary-adrenal (HPA) axis and the sympathetic nervous system. These systems release hormones and neurotransmitters, such as cortisol and adrenaline, which prepare the body for a fight-or-flight response. However, chronic stress can lead to dysregulation of these systems, affecting cognitive functions and financial decision-making.

Impact Of Stress On Financial Performance

- Impaired Decision-Making: Stress can impair cognitive functions, such as attention, memory, and judgment, leading to poor financial decisions. Stressed individuals may be more likely to engage in impulsive or risky behaviors, increasing the likelihood of financial losses.

- Reduced Risk-Taking Propensity: Chronic stress can also lead to a decreased willingness to take risks, resulting in missed opportunities for growth and profitability. This risk aversion can hinder innovation and limit an organization's ability to adapt to changing market conditions.

- Job Performance Decline: Stress can negatively impact job performance, leading to decreased productivity, absenteeism, and turnover. This can have significant financial implications for organizations, as it can disrupt operations, increase costs, and reduce profitability.

Brain Imaging Studies On Stress And Financial Performance

Several brain imaging studies have investigated the relationship between stress and financial performance. These studies have identified specific brain regions and neural pathways involved in stress-related financial decision-making. For example, one study found that individuals under stress exhibited increased activity in the amygdala, a brain region associated with fear and anxiety, when making financial decisions.

Practical Applications For Accountants

- Stress Management Programs: Accountants can work with organizations to develop stress management programs that incorporate brain imaging findings. These programs can include mindfulness-based interventions, cognitive-behavioral therapy, and relaxation techniques, which have been shown to reduce stress and improve financial decision-making.

- Financial Decision-Making Training: Accountants can provide training to financial professionals on the impact of stress on decision-making. This training can help individuals recognize the signs of stress and develop strategies for managing stress in high-stakes financial situations.

- Organizational Culture Assessment: Accountants can assess an organization's culture and identify factors that may contribute to stress, such as excessive workload, unclear expectations, or lack of support. By addressing these factors, organizations can create a more supportive and stress-free environment, leading to improved financial performance.

Brain imaging offers a powerful tool for understanding the impact of stress on financial performance. By studying the neurobiological mechanisms underlying stress and its effects on cognitive function, accountants can gain valuable insights into the human factors that shape financial outcomes. This knowledge can be used to develop practical strategies for managing stress, improving financial decision-making, and enhancing organizational performance.

YesNo

Leave a Reply